Berkeley Heights Takes on Murphy’s Education Department–and Wins!

February 20, 2024

New Initial Accreditation for NJ Center for Teaching and Learning

February 21, 2024As K-12 School Costs Rise, So Do New Jersey Property Taxes

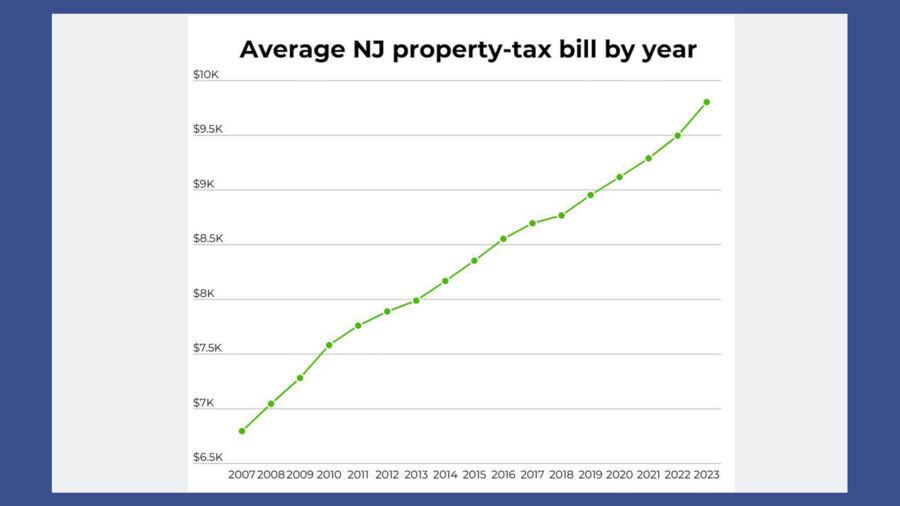

The average New Jersey property tax bill just hit a new high of $9,803, three percent higher than Fiscal Year 2023. That’s the highest annual increase in more than a decade, according to a NJ Spotlight News analysis.

Where does NJ homeowners’ collective $33 billion property tax dollars go each year? Much heads to local school districts, with the rest going to municipal and county governments, with the proportionate allocation dependent on community wealth. In posh Montclair, where the average property tax bill is the ninth highest in the state—$20,775 per home—57% of the money goes to Montclair Public Schools district, 26% goes to the Town Council, and 17% goes to Essex County government. In all, about 76% of Montclair’s K-12 school costs comes from local property taxes. For comparison, next door in Newark, the average property tax bill is $6,930, with 31% going to the public district, 54% going to City Council, and 14.8% going to Essex County. (Given the high rate of poverty in our largest school district, about 89% of Newark K-12 costs—its annual operating budget is $1.3 billion —is covered the state.)

Over the years, property tax increases have been kept in check by a a Christie Administration law which forbids districts and local governments from increasing taxes above 2%, a tough nut to crack since payroll goes up over 3% per year. When the Murphy Administration cut back on school aid for over-funded districts through a law called S2, those two mandates clashed: districts lost school aid but couldn’t recoup the loss through jumps in property taxes (with exceptions for health care, pension costs, and enrollment increases). In response, Senator Andrew Zwicker has proposed a new law that would end the 2% tax increase cap for districts that need more funding. The bill proposal passed through the Senate Education Committee last week.

During testimony, Danielle Farrie of Education Law Center Farrie and several superintendents whose districts had lost funding urged the Legislature to fix the school funding formula called SFRA. Farrie noted that the NJ Education Department is supposed to conduct an in-depth review of the formula every three years, but the formula “has not been adequately reviewed in its 15 years of implementation,” she told senators.

The bill looks likely to pass. While Gov. Phil Murphy promised to never raise taxes, he’s not running for NJ Governor again, points out Matt Friedman, so “tax hikes are definitely on the table”—not just local property taxes but state taxes too.

Senate Education Chair Vin Gopal told North Jersey,

“We have had hundreds of conversations on this topic. … We are aware of the transportation and special education and inflationary costs. It’s a great bill. We’re going to push leadership hard to move it.”

The average U.S. tax bill is $2,690, although many states don’t rely on local property taxes to pay for schools and instead rely on state revenue. The average national property tax rate is just over one percent. New Jersey’s rate is the highest among states at 2.47%.